Signed earlier this year in April, the New York State fiscal year 2022 budget brought about a whirlwind of changes for the state and new tax implications for residents.

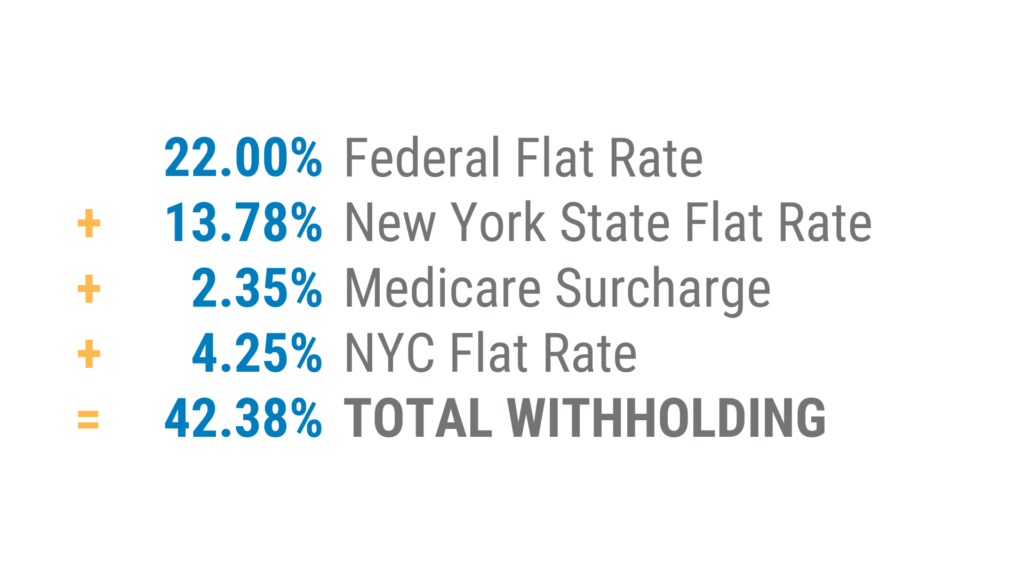

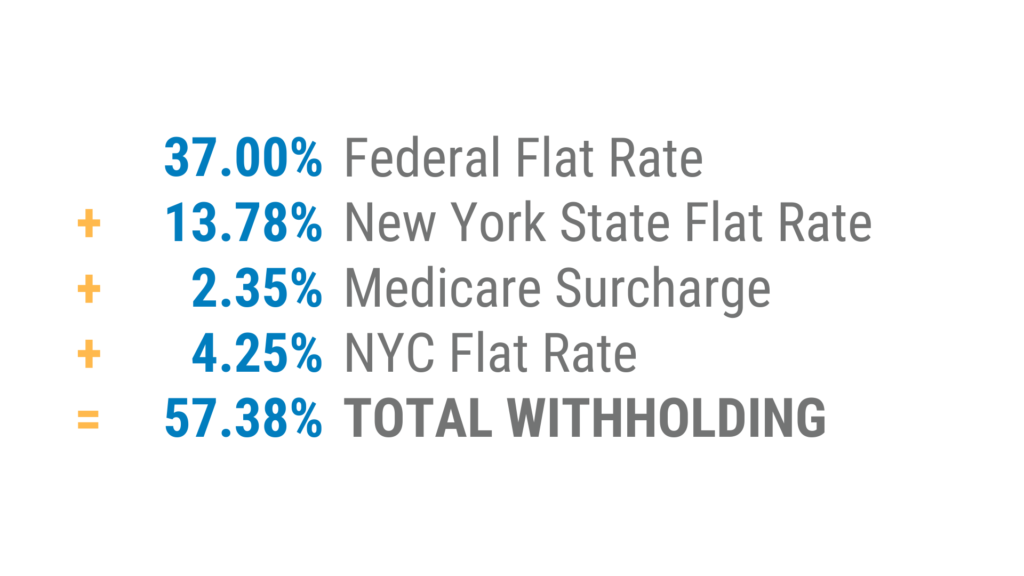

Perhaps overlooked, but a notable difference that will affect all NY taxpayers is the new supplemental wage withholding rates. As of July 1 this year, all supplemental wages are withheld at 13.78% — a significant leap from the previous 9.62%.

What’s more—depending on income or locality within the state, some taxpayers can expect higher taxes based on local rates. Along with the state’s new budget and updated tax rates, Yonkers also re-established its supplemental withholding rates at 2.3% for residents and 0.5% for nonresidents.

What Are Supplemental Wages?

Supplemental wages include any earned income from your job aside from regular wages: bonuses, commissions, overtime pay, tips, award, etc.

Let’s Crunch The Numbers

For Regular Supplemental Income:

For Supplemental Income Exceeding $1 million:

Implications

High earners will see 50% or more of their supplemental wages taken away by taxes. At the end of the day, though, all NYS residents are essentially taking a pay cut from these new rates.

For expert advice and tax planning, speak with your tax professional to discuss your options for wage withholding and learn what will work best for you. Call DSJ at 516-541-6549 and visit our website for more information.